Strategic tax planning by a CFO on call in the cannabis industry is crucial due to the complex and evolving regulatory environment in this sector. It involves managing tax liabilities, optimizing available tax benefits, and ensuring compliance with cannabis tax laws that can withstand potential audits.

Here is a sampling of how a CFO on call must develop viable options for taxes related to your business:

- Understanding tax laws for your locale(s).

- Evaluating the best entity structure, such as a C corporation, S corporation, or limited liability company (LLC).

- Tax credits, deductions, and cost accounting are vital for IRS compliance and may impact the calculation of cost of goods sold (COGS). This includes navigating the restrictions imposed by Internal Revenue Code (IRC) Section 280E, which limits the deduction of expenses related to the trafficking of controlled substances. And then developing strategies to minimize the impact on tax liabilities.

- Transfer pricing to establish appropriate transfer pricing methodologies for related entities within the cannabis business to ensure fair and compliant transactions and pricing.

- Cash handling procedures and accurate reporting of cash transactions are crucial in an industry that often relies on cash transactions due to banking challenges.

- Employee benefits and compensation plans that are tax-efficient and still comply with labor and tax regulations specific to the cannabis industry.

- Capital expenditure planning in a way that optimizes depreciation and amortization benefits, reducing taxable income.

- Strategic timing of certain transactions, such as acquisitions, asset sales, and inventory management, to minimize tax liabilities.

Strategic tax planning is one of the main topics asked about when we speak to prospective clients. It is a topic of discussion with our clients at least annually. In so many cases, the initial response regarding tax questions is, “It all depends.” Why that answer? Several factors go into tax decisions.

These examples are just a few to demonstrate the “why” of “it all depends.” A CFO on call with expertise in this sector can play a critical role in managing the strategic aspects of tax planning and ensuring the business’s financial health and sustainability. For these reasons and more, having a CFO On Call brings high value to your success.

If you need the expertise of a CFO, let’s talk. I can be reached at Bruce@CannabisCPA.Tax or 818-225-8022.

CFO Services

Why BTA Cannabis CPA Tax?

- Subject Matter Expert sought nationwide

- 30+ Years of CPA Experience

- Cannabis-specific experience since 2018

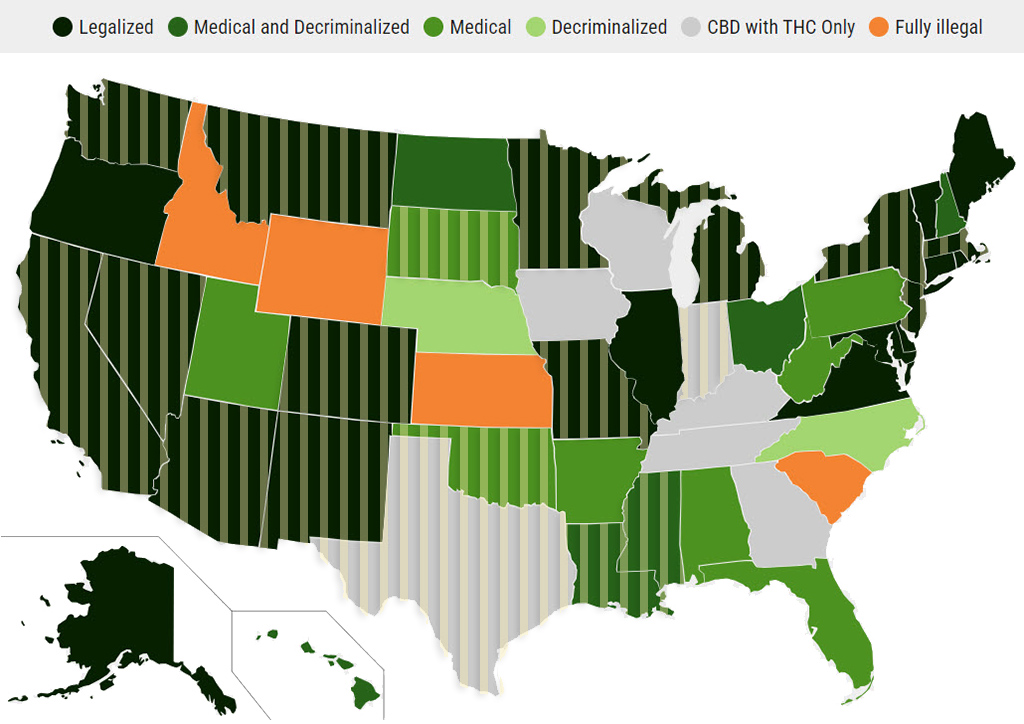

- Multi-state service area: 20 of the 24 legalized states (plus Washington, D.C.) as of 4/24/24

Tap the image to enlarge.

The striped overlay shows the 19 states (plus Washington D.C.) that BTA serves as of 11/12/23.

Map source: DISA’s Marijuana Legality by State showing legalization, medical use, and recreational use as of 10/31/23. https://disa.com/marijuana-legality-by-state