Growth planning by a CFO in the cannabis industry involves strategic financial leadership to help cannabis businesses expand and thrive in a highly regulated, constantly changing, and competitive market. CFOs can bring value in many areas:

- Conduct a thorough market analysis to identify growth opportunities, target markets, and potential areas for expansion. This includes understanding consumer demographics and preferences.

- Determine how to allocate capital for expansion, whether it’s through opening new dispensaries, launching new product lines, or entering new geographic markets.

- Develop a strategy for navigating the legal landscape, including licensing and compliance.

- Identify funding sources and assist in fundraising efforts, including seeking investors, securing loans, or accessing government grants for cannabis businesses.

- Evaluate potential merger and acquisition (M&A) opportunities and assist in negotiations to acquire complementary businesses or assets that can expedite growth. Assess and mitigate risks associated with expansion, such as regulatory changes, market competition, and operational challenges.

- Identify areas for operational improvement to streamline processes and reduce costs, enabling the business to scale efficiently.

- Develop a marketing and branding strategy to reach and engage the target audience in new markets effectively. This may involve establishing partnerships.

- Implement programs to retain and reward existing customers while attracting new ones. Customer loyalty is often a key driver of growth in the cannabis industry.

- Ensure that the supply chain can support growth by optimizing procurement, distribution, and inventory management.

- Leverage technology and innovation to enhance operational efficiency, improve product quality, and offer new products or services.

- Explore sustainability practices and initiatives that align with consumer values and regulations, as sustainability can be a significant factor in the cannabis industry.

Staying agile and adaptable to changing market trends and consumer preferences to remain competitive and meet evolving demands gives even more reasons to have a CFO On Call.

If you need the expertise of a CFO, let’s talk. I can be reached at Bruce@CannabisCPA.Tax or 818-225-8022.

CFO Services

Why BTA Cannabis CPA Tax?

- Subject Matter Expert sought nationwide

- 30+ Years of CPA Experience

- Cannabis-specific experience since 2018

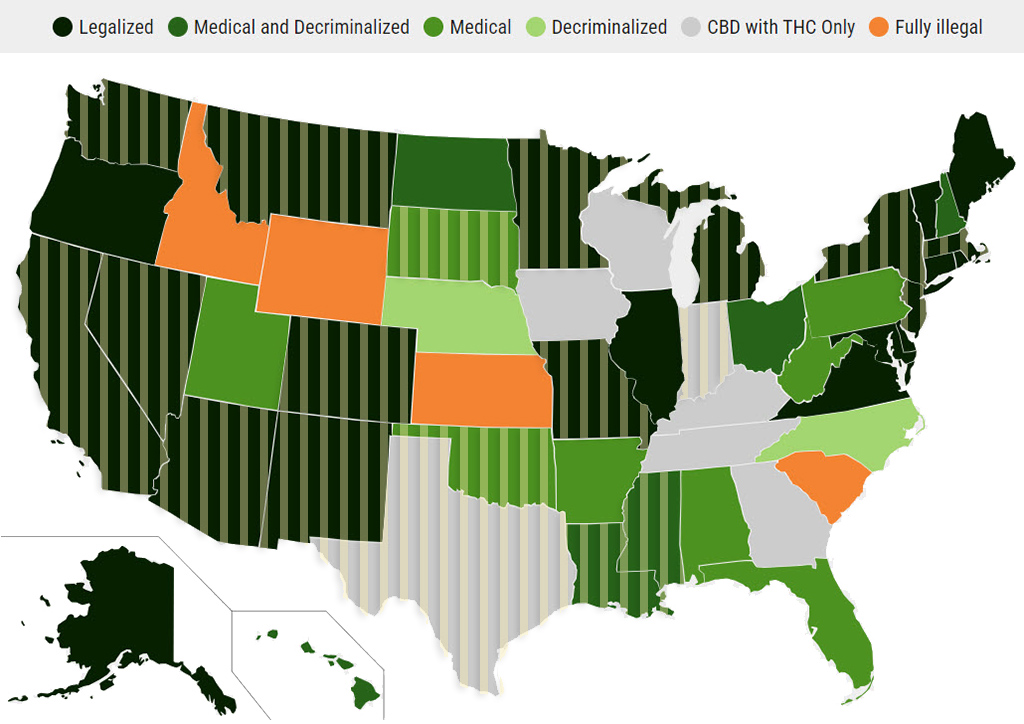

- Multi-state service area: 20 of the 24 legalized states (plus Washington, D.C.) as of 4/24/24

Tap the image to enlarge.

The striped overlay shows the 19 states (plus Washington D.C.) that BTA serves as of 11/12/23.

Map source: DISA’s Marijuana Legality by State showing legalization, medical use, and recreational use as of 10/31/23. https://disa.com/marijuana-legality-by-state