Cash flow refers to the movement of money into and out of a small business. For a business and especially a cannabis business, positive cash inflows are crucial to meet its financial obligations and fund future operations.

Cannabis businesses need to monitor and manage their cash flow for several reasons, among them:

- Emergency Fund: To have a cushion for unexpected expenses or economic downturns

- Inventory management: To ensure that cannabis operators always maintain proper inventory levels

- Profitability: To assess the overall health of the business, as positive cash flow doesn’t necessarily mean profitability.

Canna businesses often face cash flow challenges, especially during our current economic times. Therefore, having a robust cash flow management plan is crucial for their financial sustainability, survival, and growth.Top of Form

Managing cash flow effectively involves forecasting future cash flows, understanding the business’s financial cycle, and taking steps to ensure that cash inflows consistently exceed outflows.

For these reasons and more, having a CFO On Call brings high value to your operation, helping you manage a future-oriented cash flow.

If you need the expertise of a CFO, let’s talk. I can be reached at Bruce@CannabisCPA.Tax or 818-225-8022.

CFO Services

Why BTA Cannabis CPA Tax?

- Subject Matter Expert sought nationwide

- 30+ Years of CPA Experience

- Cannabis-specific experience since 2018

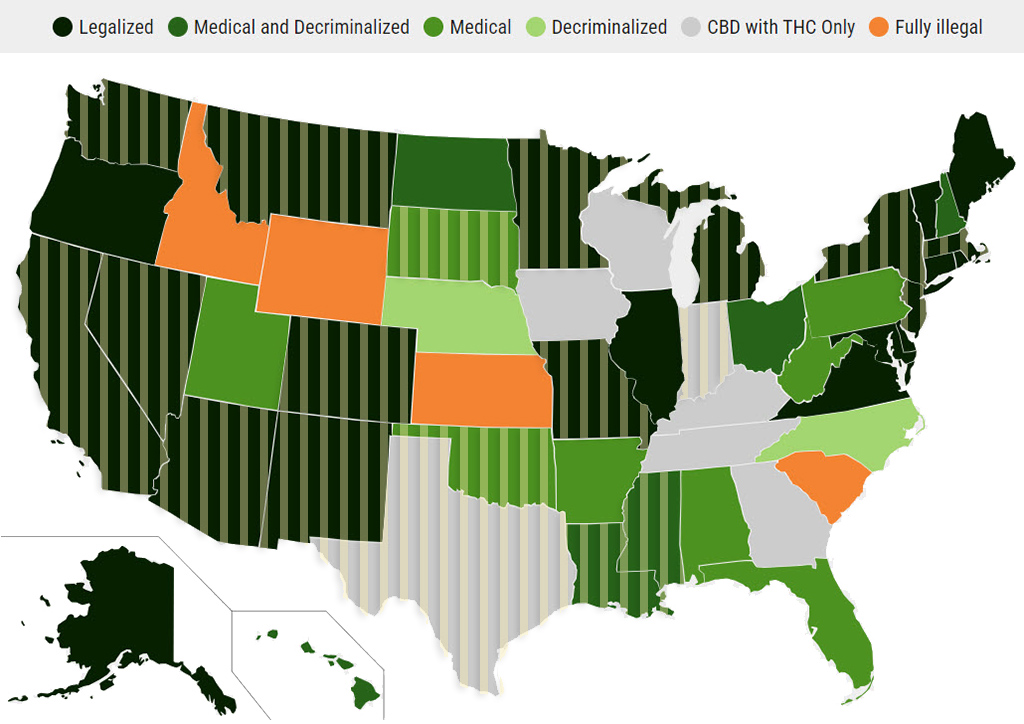

- Multi-state service area: 20 of the 24 legalized states (plus Washington, D.C.) as of 4/24/24

Tap the image to enlarge.

The striped overlay shows the 19 states (plus Washington D.C.) that BTA serves as of 11/12/23.

Map source: DISA’s Marijuana Legality by State showing legalization, medical use, and recreational use as of 10/31/23. https://disa.com/marijuana-legality-by-state