Cost accounting is a critical function in any industry. As a CFO in the cannabis sector, there are specific considerations and challenges. Staying informed about industry developments and maintaining a proactive approach to compliance and cost management is crucial to your business’ success.

Here are some key areas where CFOs guide your cost accounting:

- Implementing robust systems for tracking and managing inventory, particularly important in the cannabis space, where traceability is required for compliance purposes under 280E.

- Overseeing specialized software that integrates with seed-to-sale tracking systems to ensure accurate recording of all production and sales activities.

- Establishing the mission-critical Cost of Goods Sold (COGS)

-

- Clearly distinguishing between direct and indirect costs. Direct costs may include cultivation costs, processing costs, and packaging costs. Indirect costs may include overhead expenses, administrative costs, and compliance-related costs.

- Developing a method for allocating shared costs to different products or activities. This is important for determining the true cost of producing each product.

- Establishing accurate product costing methods such as assigning costs to each unit produced, factoring in variable and fixed costs.

- Understanding the unique factors that impact the cost of cannabis products, such as strain variability, growing conditions, seasonality, and extraction methods.

- Ensuring product quality is paramount in the cannabis industry, and the costs associated with testing and quality assurance should be factored into your overall cost structure.

- Regularly conducting a Cost Variance Analysis to compare actual costs with budgeted costs. Identify and investigate significant variances to understand their causes and take corrective actions if necessary.

- Identifying and assessing risks related to cost accounting, including regulatory risks, market volatility, and operational risks. Develop strategies to mitigate these risks.

Last but not least, given the dynamic nature of the cannabis industry, accurate financial projections are essential for strategic decision-making.

How much does your product cost? That question is asked every day by good operators.

Being a CFO in the cannabis industry involves cost accounting that navigates a complex regulatory landscape, manages unique cost factors, and ensures accurate financial reporting. For these reasons and more, having a CFO On Call brings high value to your success.

If you need the expertise of a CFO, let’s talk. I can be reached at Bruce@CannabisCPA.Tax or 818-225-8022.

CFO Services

Why BTA Cannabis CPA Tax?

- Subject Matter Expert sought nationwide

- 30+ Years of CPA Experience

- Cannabis-specific experience since 2018

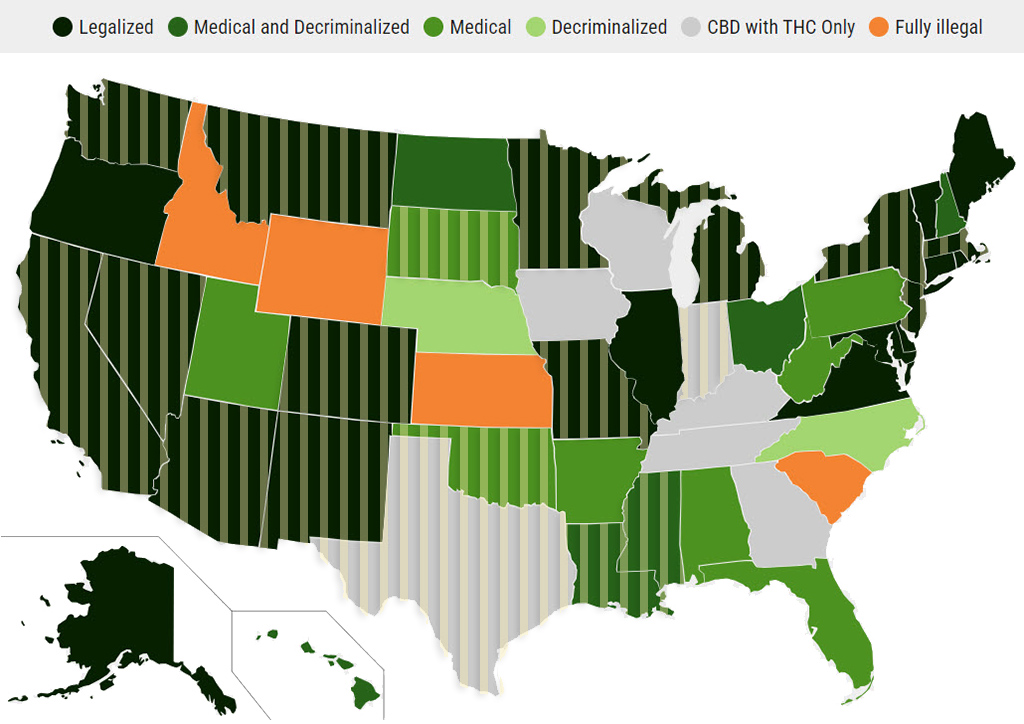

- Multi-state service area: 20 of the 24 legalized states (plus Washington, D.C.) as of 4/24/24

Tap the image to enlarge.

The striped overlay shows the 19 states (plus Washington D.C.) that BTA serves as of 11/12/23.

Map source: DISA’s Marijuana Legality by State showing legalization, medical use, and recreational use as of 10/31/23. https://disa.com/marijuana-legality-by-state