In the cannabis industry, a Chief Financial Officer (CFO) can track and evaluate Key Performance Indicators (KPIs), crucial benchmarks for effective financial management and strategic decision-making. Here are some key KPIs that are particularly relevant to the cannabis industry, along with considerations for their evaluation:

- Revenue Growth: Percentage increase in revenue over a specific period.

- Considerations: Monitor revenue growth to assess the effectiveness of sales and marketing strategies. Is growth sustainable? Does it align with market trends?

- Gross Margin: Percentage difference between revenue and cost of goods sold (COGS).

- Considerations: Analyze gross margin to understand profitability at the production level. Identify trends and factors impacting margins, such as changes in production costs or pricing strategies.

- Cost per Gram (or Unit) Produced: Total production costs divided by the quantity of cannabis produced.

- Considerations: Evaluate cost efficiency in cultivation and production. Monitor fluctuations in input costs and assess the impact on the overall cost structure.

- Inventory Turnover: Number of times inventory is sold or used over a specific period.

- Considerations: Higher inventory turnover indicates efficient production and sales processes. Analyze slow-moving inventory and take steps to minimize excess stock.

- Cash Flow: Operating cash flow and free cash flow.

- Considerations: Monitor cash flow to ensure liquidity and financial stability. Evaluate the ability to cover operational expenses, invest in growth, and manage debt obligations.

- Return on Investment (ROI): Measure of the profitability of an investment.

- Considerations: Assess the ROI of major capital expenditures, marketing campaigns, and expansion initiatives. Ensure that investments contribute positively to overall financial performance.

- Compliance Metrics: Percentage of regulatory compliance achieved.

- Considerations: Given the stringent regulations in the cannabis industry, track and report on compliance metrics. Non-compliance can result in fines or license revocation.

- Average Sale per Customer: Average revenue generated per customer.

- Considerations: Understand customer behavior and preferences. Identify opportunities to increase customer spending through targeted marketing or product offerings.

- Customer Acquisition Cost: Cost associated with acquiring a new customer.

- Considerations: Evaluate the efficiency of marketing and sales efforts. Compare acquisition costs to customer lifetime value to ensure a positive return on investment.

- Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA): Measure of operational profitability.

- Considerations: Assess EBITDA to understand the core profitability of the business, excluding non-operational factors. Compare EBITDA margins with industry benchmarks.

- Debt Levels and Ratios: Debt-to-equity ratio, interest coverage ratio.

- Considerations: Monitor debt levels and assess the company’s ability to service debt.

- Brand Awareness and Loyalty Metrics: Measure of brand recognition and customer loyalty.

- Considerations: Track loyalty metrics such as brand mentions, customer satisfaction, and Net Promoter Score (NPS).

- Market Share: Percentage of the total market captured by the company.

- Considerations: Evaluate market share to understand the competitive position. Monitor changes in market dynamics and adjust strategies accordingly.

- Employee Productivity: Revenue per employee, labor cost as a percentage of revenue.

- Considerations: Assess the efficiency of the workforce. Optimize staffing levels and productivity to manage labor costs effectively.

- Environmental and Sustainability Metrics: Environmental impact, sustainable practices.

- Considerations: Evaluate the company’s commitment to environmental responsibility. Increasingly, investors and consumers are considering sustainability practices when choosing cannabis products.

When evaluating these KPIs, it’s important to consider industry benchmarks, compare trends over time, and factor in external influences such as regulatory changes and market dynamics. Regularly reviewing and adapting your KPIs will help ensure that they remain relevant to the evolving landscape of the cannabis industry. And that’s exactly what a CFO will help you do.

For these reasons and more, having a CFO On Call brings high value to your success.

If you need the expertise of a CFO, let’s talk. I can be reached at Bruce@CannabisCPA.Tax or 818-225-8022.

CFO Services

Why BTA Cannabis CPA Tax?

- Subject Matter Expert sought nationwide

- 30+ Years of CPA Experience

- Cannabis-specific experience since 2018

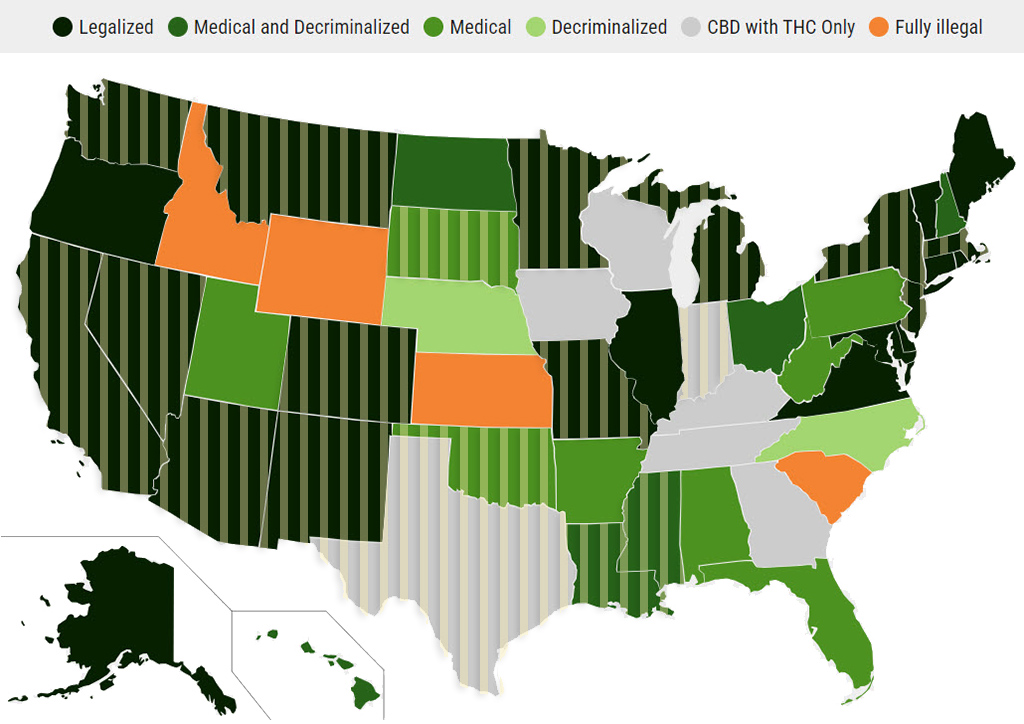

- Multi-state service area: 20 of the 24 legalized states (plus Washington, D.C.) as of 4/24/24

Tap the image to enlarge.

The striped overlay shows the 19 states (plus Washington D.C.) that BTA serves as of 11/12/23.

Map source: DISA’s Marijuana Legality by State showing legalization, medical use, and recreational use as of 10/31/23. https://disa.com/marijuana-legality-by-state