Articles

Trump Signs Executive Order, December 18, 2025 – Cannabis to Be Rescheduled

This action by the President is a monumental move forward for the cannabis industry. Some have called this the most [...]

280E: The Tax Code Designed to Gut the Cannabis Industry

For most businesses, there isn’t a single tax code provision they dwell on as the bane of their existence. But [...]

The Master Framework of Logical Fallacies: Applied to the Cannabis Industry

“It is the mark of an educated mind to be able to entertain a thought without accepting it.” – Aristotle [...]

What Cannabis Rescheduling Could Mean, Part 3: The Patient Experience

Rescheduling would represent a monumental shift in access, allowing some of the most vulnerable populations to obtain safe, consistent cannabis [...]

Thriving in a Pre-Federal-Legalization Market

We’ve been teased for some time. Not with full legalization of cannabis, but rescheduling it from a Schedule I narcotic [...]

What Cannabis Rescheduling Could Mean, Part 2: Rescheduling ≠ Legalization

As a seasoned cannabis executive who has steered through every regulatory twist, from the dawn of medical programs to the [...]

SAFE Banking: Progress or Mirage?

The cannabis industry desperately needs banking solutions. Loans are crucial. Cash needs to be deposited. Etc. Yet, due to its [...]

Thomas Andersen Joins Rolling Stone Culture Council

FOR IMMEDIATE RELEASESeptember 13, 2025 Thomas Andersen Joins Rolling Stone Culture Council Los Angeles, CA – BTA Cannabis CPA Tax [...]

What Cannabis Rescheduling Could Mean, Part 1: The Real Cost of Bringing Medicine to Market

"The cure for anything is salt water: sweat, tears, or the sea." - Isak Dinesen. If only it were that [...]

Regs & Roots: Why Cannabis Laws Grow Better When Operators Help Write Them

The cannabis industry has long had to contend with various laws and outdated thinking. These roadblocks have hampered operators' ability [...]

Whitepaper: Oklahoma State Question 837 – A Recreational Cannabis Initiative

Executive Summary Oklahoma State Question 837 (SQ 837) proposes a constitutional amendment to legalize adult-use cannabis in Oklahoma. Building on [...]

Mid-year Key Compliance Reminders for Cannabis Operators

Some people like to leave important things until the last minute. They thrive on the tension of being down to [...]

How to Approach Tax Strategy in a Cannabis Business

Tax strategy may not get everyone's (or anyone's) heart racing, but it is essential for your operation’s success. In the [...]

July 30, 2025 — Los Angeles Dept of Cannabis Regulation – Virtual Lunch Hour: Annual Licensing Q&A

Who:Los Angeles Department of Cannabis Regulation (DCR) What:Join DCR’s Virtual Lunch Hour — a live Q&A session with Assistant Executive [...]

Structuring Your Cannabis Business for Long-Term Success

Pretty much the only thing straightforward about the cannabis industry is the enjoyment the plant gives. Everything involved in the [...]

Bruce T. Andersen, CPA, Honored as Cannabis Accountant of the Week – 7/21/2025

FOR IMMEDIATE RELEASEJuly 22, 2025 Bruce T. Andersen, CPA, Honored as Cannabis Accountant of the Week Los Angeles, CA – [...]

What Investors Want to See in Cannabis Financials: Part Two

In part one, we discussed the importance of scalability and unit economics, as well as strong leadership, regarding your cannabis [...]

What Investors Want to See in Cannabis Financials: Part One

The cannabis industry operates in murky, unpredictable waters, which creates distinct challenges for financial readiness. Investors will examine scalability, unit [...]

How Cannabis Operators Can Stay Financially Organized

We have written extensively about the dangers of slipshod financial management. In short, bad financial organization for your cannabis business [...]

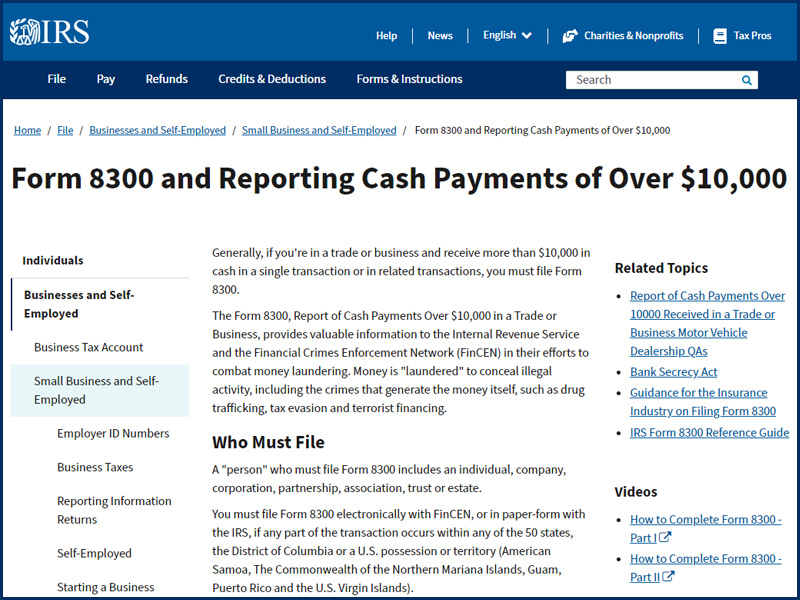

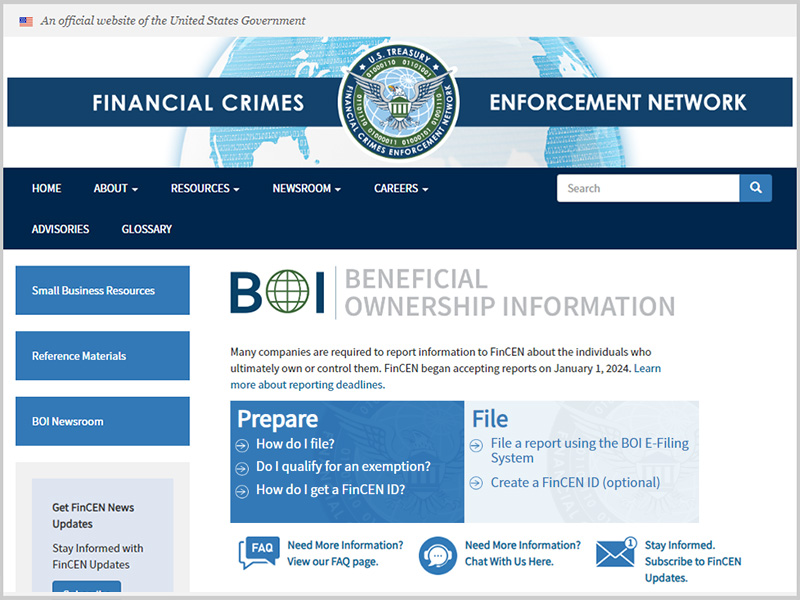

Form 8300 vs. Marijuana SARs, Part 2: Understanding the Marijuana SAR Categories

In the world of cannabis finance, transparency is both a survival skill and a compliance necessity. State-legal cannabis businesses operate [...]

Why We Don’t Service the Psychedelics Industry

From a Cannabis CFO: Focused on the Cannabinoid Economy At BTA Cannabis CPA Tax, we serve one lane — and [...]

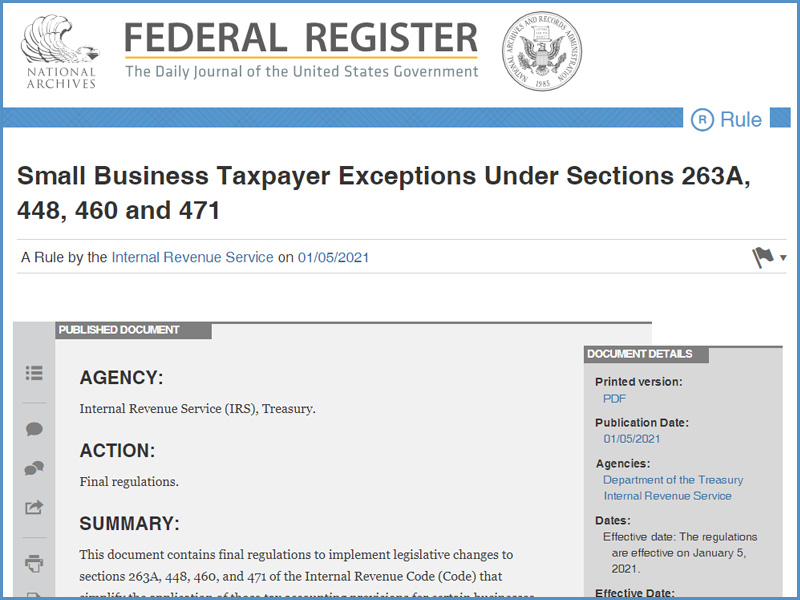

The Cannabis Industry’s Quiet Tax Win: § 471(c) Goes Permanent

If you're an investor, operator, executive, or compliance lead in the cannabis industry, let me be blunt: IRC § 471(c) is [...]

Staying Compliant While California Cannabis Excise Tax Holds at 19%

As of July 1, 2025, California’s cannabis excise tax rate increased from 15% to 19%, following a scheduled adjustment tied [...]

Understanding State-Level Cannabis Tax Pressure

No one enjoys paying taxes. People in the cannabis industry enjoy paying them even less, as cannabis tends to be [...]

July 9th, 2025 – Press Release – NCIA Committee Selections – Bruce and Thomas Andersen

Thomas Andersen selected to be a member of the NCIA State Regulations Committee; Bruce Andersen CPA, selected to NCIA Banking [...]

What’s New in Cannabis Accounting This Year?

If you are in the cannabis industry, it would behoove you to stay abreast of cannabis accounting updates. It's the [...]

What It Takes to Cut It as a Cannabis CFO

By Thomas Andersen, Cannabis CFO, Who’s Sat in the Operator Chair and the Investor Room, as first seen posted on [...]

What Your CPA Should Already Be Telling You About 280E

In our previous article on what cannabis CPAs look for in an operator, we discussed the risks of a cannabis [...]

3 Red Flags that Scare off Cannabis Investors (and How to Fix Them)

Whether you’re a startup looking for pre-seed funding or a multinational company seeking Series C+ funding, your cannabis operation will [...]

IRS Audit Red Flags: 5 Cannabis Finance Missteps

Being audited is like being pulled over by the police: even though you’re sure you haven’t done anything wrong, you [...]

Careers with Cannabis: What Cannabis CPAs Want in an Operator

Cannabis CPAs (Certified Public Accountants) are the unsung heroes of a cannabis business. Their expertise can be the difference between [...]

Court Bars Cannabis Businesses from Employee Retention Credits

The ongoing federal prohibition of cannabis continues to ripple through the U.S. business landscape, particularly for state-legal marijuana companies seeking [...]

Minnesota’s Cannabis License Lottery: High Drama, Low Blows, and a Bumpy Green Rush

Move over, reality TV — Minnesota’s cannabis licensing process is delivering all the drama, suspense, and accidental plot twists you [...]

Comprehensive Analysis of Liquidity Ratios in the Cannabis Industry

Introduction Liquidity ratios are fundamental financial metrics that provide insight into a company’s ability to meet its short-term obligations. These [...]

KPIs – Manufacturing and Distribution Model

For a cannabis manufacturing and distribution (mfg & distro) business, tracking the right KPIs is essential for operational efficiency, regulatory [...]

Why CFOs With Cannabis Experience Are Scarce (and Valuable)

You can’t throw a rock without hitting a “content creator” or “influencer.” These are job titles that anyone can give [...]

Expanding Dispensary Hours: Increasing Tax Revenue for Los Angeles

San Diego is once again leading the way in progressive cannabis policy, with city officials now considering proposals to extend [...]

5 Signs Your Cannabis Finance Team Isn’t Investor-Ready

If you are looking to scale your cannabis business, you will need additional funding, most likely from professional investors. However, [...]

Where’s My Refund?

Methods of Researching Refund Status To check the status of your federal tax refund, use the official IRS “Where’s My [...]

Disaster Relief Resources concerning Tax Agencies

Dates, deadlines, and contact information for the various tax agencies 20250114 - #Tax #Relief in Response to #LosAngeles County [...]

Form 8300 as it relates to the Cannabis Industry

Form 8300 is for reporting cash transactions over $10,000. That is the simple definition. The form must be filled out [...]

Can 471(c) help your tax situation?

So, what is IRC 471(c) and how can it help? IRC 471(c) is a newer code section of the Internal [...]

Nick Richards of Greenspoon Marder – Cannabis Quick Hits: Accounting in the Cannabis Space – Speaking Engagement

August 8, 2022 Bruce T. Andersen was invited by Nick Richards, Partner and Co-Chair of Greenspoon Marder's Cannabis Law Group, [...]

Corporate Transparency Act – New law effective January 1, 2024

This law is titled the Corporate Transparency Act (“CTA”) and affects all companies doing business in the United States. It [...]

280E – The current Achilles’ heel of the cannabis business

Code Section 280E of the Internal Revenue Code is titled “Expenditures in connection with the illegal sale of drugs.” It [...]

The Impact of 280E on Your Accounting World

Let’s remember why the issue of special tax reporting even is an issue for the legal Cannabis industry. As long [...]

Cannabis Rescheduling at the Federal Level – What to Expect

As posted May 21, 2024 on The Woodard Report Visit Bruce's articles channel on The Woodard Report HERE. [...]

Rescheduling Cannabis through DEA – its impact on IRC 280E

On May 1, 2024, the Drug Enforcement Agency of the federal US government (“DEA”) announced it was in serious consideration [...]

Why is QuickBooks the Leading Cannabis Accounting Software?

In the cannabis industry, QuickBooks is the leading accounting software used by both accounting professionals as well as cannabis companies. [...]

Cannabis and QuickBooks – an Interesting Market

We have been a part of almost every program that QuickBooks (QB) has offered for over twenty years. The keys [...]

BOLDLY | GO: Meet the Panelists for the Cannabis Presentation at Scaling New Heights 2024

As posted May 23, 2024 on The Woodard ReportVisit Bruce's articles channel on The Woodard Report HERE. Please meet the panelists for [...]

A new IRS directive… To ERC or Not to ERC, that is the question.

Posted 10/26/23 As with other government programs during the pandemic, the IRS Employee Retention Credit (ERC) program put needed money [...]

Support NACAT – Vote Now!

Bruce Andersen CPA, a founding member of the National Association of Cannabis Accounting and Tax Professionals (“NACAT Pros”), is very [...]

Business Income Taxes for 2023: Cannabis-specific

The 2022 year has been a very big year for changes in the taxation of cannabis in California that will [...]

Business Income Taxes for 2023: General

Here are a wide variety of general tax matters, from property taxes to income taxes, as they will play out [...]

Staying above the water line at MJBizCon 2022

I continue to grow the breadth and depth of my knowledge in the Cannabis space, all the while meeting [...]

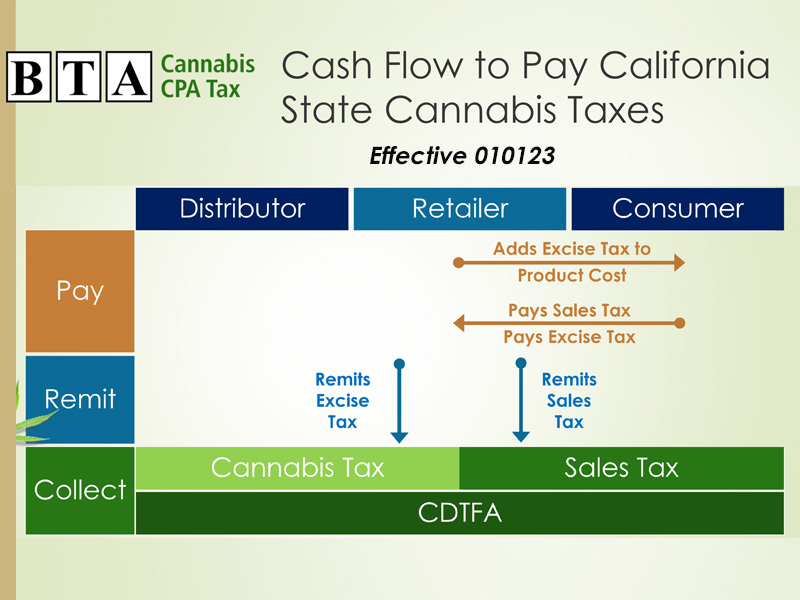

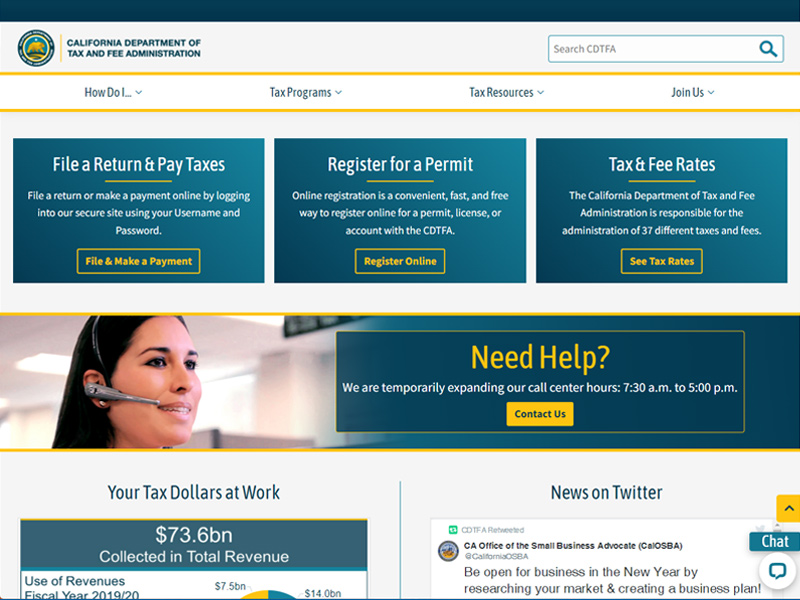

CDTFA California State Changes to Processing Cannabis Excise and Sales Taxes

Posted November 13, 2022 This has been a very big year for changes in the Cannabis industry regarding excise and [...]

CalCPA Cannabis Business Virtual Symposium – Speaking Engagement

November 9 from 3:15–4:05 PM (PDT) Compliance and Enforcement Management from a Practitioner’s Perspective Topics to be covered by Bruce [...]

DOPE CFO on Social Equity Cannabis License – Speaking Engagement

5 Crucial Tips for Social Equity Cannabis License Applicants Oct 19, 2022 02:00 PM PDT DOPE CFO gathered experts including [...]

Montecito Mudslides

Five years to the day in Montecito Wow, Mother Nature is not happy. Five years to the day, Montecito has [...]

CDTFA Cannabis Special Notice – California Cultivation Tax Ends on July 1, 2022

What wonderful news! There is no cultivation tax effective July 1, 2022. This is all with the stroke of a [...]

Retail shops will pay less for excise tax effective July 1, 2022

CORRECTION posted July 5, 2022 Effective July 1, 2022, the CDTFA is making a change to the cannabis excise tax. [...]

California Cannabis Tax Rates Changed January 1, 2022

What happened to the reporting form? Effective January 1, 2022, the tax rates on cultivation cannabis excise tax increased about [...]

Hey, please cut the IRS some slack…

…they are doing the best they can… REALLY? Wow, how time flies. We are already at the end of February. [...]

2022 Tax-Related Dates – Income Tax Due Dates

I wanted to provide some key dates for the income tax season. S-Corporations, LLCs taxed as Partnerships, or Partnerships All [...]

Some good and some bad news from the CDTFA for 2022

Bad news first. Cultivation tax is being raised again effective 1/1/2022. It is increasing about 4.5% year over year. Very [...]

A Gift from the IRS to the Cannabis Industry

The IRS is now recognizing that the cannabis industry exists and should provide some guidance to the taxpayers. Their ‘gift’ [...]

Cannabis CPA: AUDIT

In the Cannabis Industry, it is not a question of IF a company will be audited but WHEN. Due to the high revenue [...]

Happy Anniversary 4/20/21!

This is a special year for cannabis taxation like no other. In the area of federal taxation, I cannot imagine [...]

Weeding the News: March 26, 2021

The information contained in Weeding the News issues is provided for informational purposes only and should not be construed [...]

Weeding the News: March 1, 2021

The information contained in Weeding the News issues is provided for informational purposes only and should not be construed [...]

COVID-19 Tax-Relevant Information

The coronavirus is impacting the deadlines for income tax filings in 2020. How the federal and state governments have made [...]

The Insanity of Cannabis Accounting & Tax: Accounting & Finance Show LA 2019

David Leary and Blake Oliver, CPA, co-founders of the Cloud Accounting Podcast, met with cannabis accounting experts, Bruce and Thomas [...]

Cannabis CPA: TAX

In the Cannabis industry taxes are very important at local, state, and federal levels. Currently, all references to local and [...]

Cannabis CPA: ACCOUNTING

All businesses need a solid accounting system. Cannabis companies need it even more in an area of regulation that seems [...]

Cannabis CPA: SYSTEMS

The cannabis industry is highly regulated and highly automated. It is important to match the size of the business to [...]