Posted November 13, 2022

This has been a very big year for changes in the Cannabis industry regarding excise and sales taxes.

Cultivation Excise Taxes

Cultivation excise taxes were eliminated at midyear, June 30, 2022. For the industry, this was a great step forward. To an outsider, the expectation was to have a lower cost of the product. What really happened was that the supply chain quickly adjusted for this change, leaving the cultivator with little or no change in their costs. The only licensee prior to July 1, 2022, that was legally able to remit this cultivation excise tax was a distributor. This change freed up the distribution licensees from managing this cash. This is viewed by the industry as a very positive change.

Cannabis Excise Tax

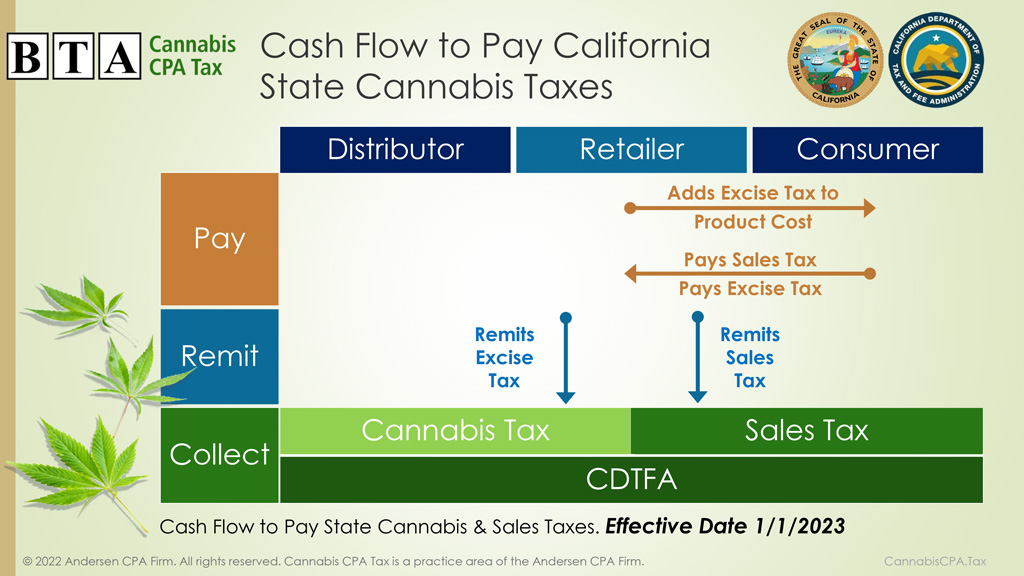

The remaining cannabis excise tax has a big change going into effect on January 1, 2023.

- The markup pricing matrix which started on January 1, 2018, is gone. This is where the CDTFA set a markup rate for the distributors to use as a base for the selling price to the retailer.

- Now the price that the retailer will use as a base for computing the excise tax is simply the market value for what the retailer pays. If the retailer buys the product at $100, the rate of 15% applies to this purchase and the excise tax is $15.

- The excise tax is added to the price the retailer paid for the product, and the combined amount is then paid by the retail consumer.

- There is no excise tax on non-cannabis products.

- The retailer collects the excise tax in #3 and remits this tax per the CDTFA filing schedule, currently quarterly.

There are a few other tidbits to note.

- It is planned that the CDTFA will be closing the cannabis excise tax account for distributors in December 2022. Does that make sense? CDTFA is jumping the gun, as Q4 2022 cannabis tax returns will still need the distributors to be filing tax returns. Oh, and how about chargebacks from retailers to distributors? This cannot be completed by Q4 2022. Look for this timetable to move to Q1 2023.

- It is planned that the CDTFA will automatically open cannabis tax accounts for all retail license holders in December. Retailers will have to look for these new account numbers. The first cannabis excise tax report will be filed at the end of Q1 2023, so be looking for the licenses no later than January 2023.

- Any products in inventory as of 12/31/2022 which were purchased in 2022 already have excise tax calculated on the product, and the excise tax will be remitted through the distributor. Be sure the retailer is not paying excise tax twice, and there are good records showing the calculations.

- Be sure that the POS vendors are contacted to assist in making any changes needed for the tax calculations.

Cannabis Sales Tax

Let’s talk about the cannabis sales tax requirements next.

- This reporting requirement generally is the same in 2023. Same sales tax account number, etc.

- It is important to point out that the sales tax is to be applied to product cost plus excise tax plus delivery cost plus any local tax on the consumer invoice.

Stay tuned. More changes are coming in 2023. Major details have yet to be worked out. We will keep you informed when it is available.

Questions?

Please contact Bruce@CannabisCPA.Tax.