Bad news first.

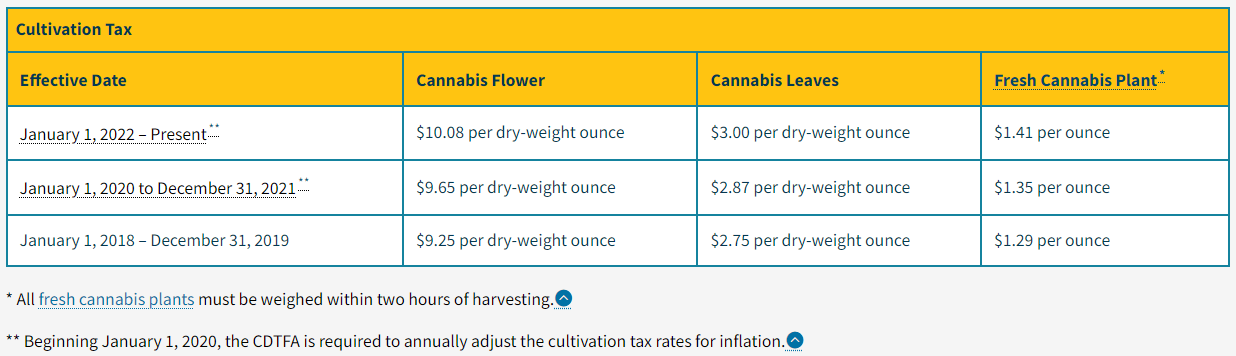

Cultivation tax is being raised again effective 1/1/2022. It is increasing about 4.5% year over year. Very sad for a market that has been very soft in 2021. Additionally, the cultivation tax is up about 9% since inception on 1/1/2018.

The rates are shown below for the changes.

Reference: CDTFA website

Now some good news.

Trade samples that are provided to other licensees are not taxable. This is a part of Assembly Bill 141.

Here is an excerpt from the CDTFA website.

Cannabis Trade Samples – Assembly Bill 141 (AB) (Stats. 2021, ch. 70) will also allow cannabis licensees to provide trade samples to other licensees for targeted advertising of cannabis and cannabis products under the Department of Cannabis Control’s regulations. Beginning January 1, 2022, AB 141 also exempts from cultivation tax, all harvested cannabis that will be, or has been, designated a trade sample and all harvested cannabis that is used to manufacture a cannabis product that is designated a trade sample. Additionally, the cannabis excise tax does not apply to cannabis or a cannabis product designated as a trade sample that is given to another licensee without consideration.

We have to remember that the black market is still alive and well. We hope in 2022 the state will work to protect the licensed operators and make it unprofitable to exist as a black-market operator.

If you have any questions, please contact me by email at Bruce@CannabisCPA.Tax or phone 818-225-8022.