This is a special year for cannabis taxation like no other. In the area of federal taxation, I cannot imagine a more significant and more diverse year than the year that wrapped up on 4/20/2021.

- Slightly before the beginning of the year, a part of the Trump Tax Laws (“TCJA”) Code section 471(c) was introduced effective 1/1/2018. It is not cannabis-specific, but the cannabis industry can adopt it.

- It is a part of Small Business Accounting Method Reform.

- It can allow for more costs to be accounted for as Cost of Goods Sold.

- This will lower the impact of 280E for a cannabis business.

- Kicking off the year (plus a little) was the Treasury Inspector General for Tax Administration (TIGTA) report issued March 30, 2020: The Growth of the Marijuana Industry Warrants Increased Tax Compliance Efforts and Additional Guidance.

- It included five recommendations for activities that the IRS can do to improve guidance, compliance, and education of the marijuana industry.

- It included a sixth recommendation, not agreed to by the IRS, which had to do with providing guidance on 471(c).

- We went through the summer with a variety of professionals providing their understanding of 471(c).

- Some advocated putting ALL expenses of the cannabis business into Cost of Goods Sold. This is a bit over the top but points to why the TIGTA report asked the IRS to provide guidance.

- Others had you sit through an entire webinar, provided little or no information, and then at the end, provided the hook… “call us to discuss your specific situation.”

- Yet others provided some balance but hedged their bets as to what 471(c) really means and how to deploy it.

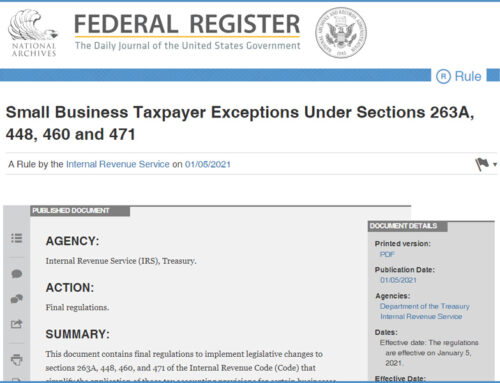

- August found proposed regulations being issued by the IRS under the title, “Small Business Taxpayer Exceptions Under Sections 263A, 448, 460 and 471.” (It is a shame that this document could not have been issued just for 471(c).)

- For sections relating to 471(c), there are some definitions and examples which help in the IRS’s understanding of the sub-code section.

- As proposed regulations, they are only that. Until final regulations are published, the proposed regs only provide some indication of the direction the IRS wants to take going forward.

- On January 5, 2021, final regulations were issued by the IRS. The official title is the same as the proposed regulations: “Small Business Taxpayer Exceptions Under Sections 263A, 448, 460 and 471.”

- It includes some changes to the proposed regulations.

- An interesting dilemma is now facing the tax professional as to what to use as professional guidance with what effective date? Original law for 471(c) was effective 1/1/2018. The final regs are effective 1/5/2021. Either is good tax law.

- In February 2021, a Tax Court case named San Jose Wellness was handed down. A medical cannabis dispensary was faced with the disallowance of 280E.

- The case was for the tax years 2010–2015, older years in regard to 280E.

- The tax court held that 280E was properly applied, which as continued to cement the position of the IRS that application of 280E to the cannabis business is good tax law.

- In March 2021, I participated as a webinar panelist for a national organization of cannabis tax professionals. On the nationally broadcast webinar were two very high-ranking, senior members of the IRS National Office for Examination.

- I participated in developing the materials for the presentation.

- We learned that the IRS was in the process of developing a Cannabis Audit Technique Guide.

- There were other discussions focused on how the IRS manages auditing of cannabis companies.

- This was the highlight of my “420 Fiscal Year” – until April 2021.

- In April 2021, I attended a webinar sponsored by MJ Biz Daily. This turned everything I had heard in March from the IRS representatives upside down. Through Freedom of Information Act Requests, thank you MJ Biz Daily, I discovered that the IRS had been conducting specific projects in the area of cannabis for years.

- The first compliance initiative project of the IRS was started in 2010.

- A revised marijuana guide was dated 2015. It covered everything down to the visual attributes of the cannabis plant types.

- Section 280E expenses were studied in 2016.

- I found several PowerPoint presentations from 2016 and 2017 covering everything from federal tax, audit techniques, separate businesses, exam issues, and collection issues to understanding medical marijuana returns.

This is a summary of the cannabis year in review from the federal tax perspective of what I have seen. As I started this article, I realized “wow, what year it has been for cannabis taxation.”

The next question is always “what about next year?”

- The IRS is expected to OFFICIALLY publish a Cannabis Audit Technique Guide. In March, the word was that it is just waiting for legal review.

- Increased number of examinations, just because it appears to be mandated.

- The IRS will face a real dilemma: as more states become legal, will federal taxation maintain the same power over cannabis businesses?

Standard Disclaimer: This information is provided as general business information and not tax or accounting advice. If you have specific questions, please seek counsel from a tax professional.

I can be reached at Bruce@CannabisCPA.Tax or 818-225-8022. Learn more at www.CannabisCPA.tax.

Bruce Andersen has provided financial and accounting expertise to dozens of companies over his thirty years as a licensed CPA in California. In 2018, he formed a separate division of his CPA firm committed to the cannabis industry, Cannabis CPA Tax (CannabisCPA.tax).

Mr. Andersen has developed expertise in the California Cannabis industry, providing financial and accounting services to several dozen cannabis and hemp operators. The uniqueness of his services is his understanding of the complete system of the cannabis industry from seed-to-sale and from the state’s METRC system through the operator’s accounting system and to the final income tax return. This provides not only high-quality financial reporting but discrete cost and management reporting.

Mr. Andersen holds advanced degrees from Golden Gate University (M.S. Tax), Boston University (MSBA – Operations Research), and California State University-Bakersfield (MBA-Finance). His B.S. is in Industrial Administration (Iowa State University). He has taught accounting, finance, and business systems at the School of Business, University of Phoenix for over fifteen years.

© 2021 Bruce Andersen, CPA. Cannabis CPA Tax. All rights reserved. CannabisCPA.tax