Cannabis Industry Services

As a practice area of the long-standing CPA firm, Andersen CPA, we know your business.

Cannabis CPA Tax provides service to our clients in several states and our expertise is sought nationwide.

Cannabis CPA: AUDIT

In the Cannabis Industry, it is not a question of IF a company will be audited but WHEN. […]

Cannabis CPA: TAX

In the Cannabis industry taxes are very important at local, state, and federal levels. Currently, […]

Cannabis CPA: ACCOUNTING

All businesses need a solid accounting system. Cannabis companies need it even more in an […]

Cannabis CPA: SYSTEMS

The cannabis industry is highly regulated and highly automated. It is important to match the […]

Tax-Related Articles

California Cannabis Tax Rates Changed January 1, 2022

What happened to the reporting form? Effective January 1, 2022, the tax rates on cultivation cannabis excise tax increased about four percent for the various [...]

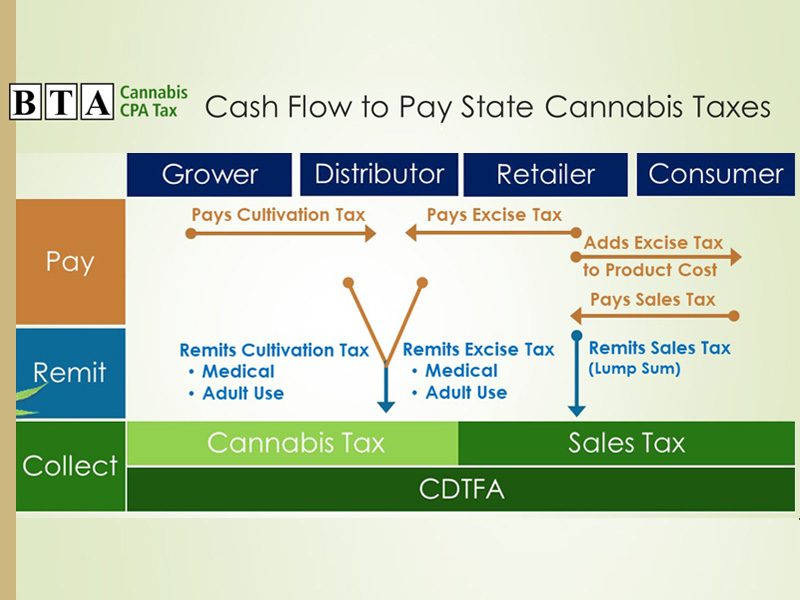

Cash Flow to Pay State Cannabis Taxes

This slide from Bruce Andersen's presentation on the State and Local Tax Panel at 2019 CalCPA Cannabis Symposium is so important in Cannabis business accounting [...]

Hey, please cut the IRS some slack…

…they are doing the best they can… REALLY? Wow, how time flies. We are already at the end of February. Of course, a big thing [...]

2022 Tax-Related Dates – Income Tax Due Dates

I wanted to provide some key dates for the income tax season. S-Corporations, LLCs taxed as Partnerships, or Partnerships All three are due on March [...]

Some good and some bad news from the CDTFA for 2022

Bad news first. Cultivation tax is being raised again effective 1/1/2022. It is increasing about 4.5% year over year. Very sad for a market that [...]

A Gift from the IRS to the Cannabis Industry

The IRS is now recognizing that the cannabis industry exists and should provide some guidance to the taxpayers. Their ‘gift’ is a section of the [...]