Cannabis Industry Services

As a practice area of the long-standing CPA firm, Andersen CPA, we know your business.

Cannabis CPA Tax provides service to our clients in several states and our expertise is sought nationwide.

Cannabis CPA: AUDIT

In the Cannabis Industry, it is not a question of IF a company will be audited but WHEN. […]

Cannabis CPA: TAX

In the Cannabis industry taxes are very important at local, state, and federal levels. Currently, […]

Cannabis CPA: ACCOUNTING

All businesses need a solid accounting system. Cannabis companies need it even more in an […]

Cannabis CPA: SYSTEMS

The cannabis industry is highly regulated and highly automated. It is important to match the […]

Tax-Related Articles

A new IRS directive… To ERC or Not to ERC, that is the question.

Posted 10/26/23 As with other government programs during the pandemic, the IRS Employee Retention Credit (ERC) program put needed money into the hands of many [...]

Business Income Taxes for 2023: Cannabis-specific

The 2022 year has been a very big year for changes in the taxation of cannabis in California that will affect what happens in 2023. [...]

Business Income Taxes for 2023: General

Here are a wide variety of general tax matters, from property taxes to income taxes, as they will play out in 2023. Secured Property Tax [...]

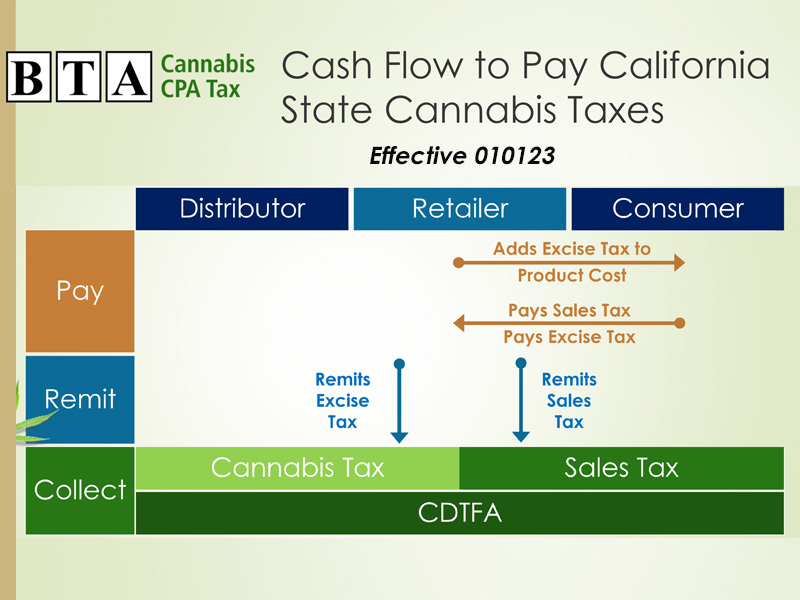

CDTFA California State Changes to Processing Cannabis Excise and Sales Taxes

Posted November 13, 2022 This has been a very big year for changes in the Cannabis industry regarding excise and sales taxes. Cultivation Excise Taxes [...]

CDTFA Cannabis Special Notice – California Cultivation Tax Ends on July 1, 2022

What wonderful news! There is no cultivation tax effective July 1, 2022. This is all with the stroke of a pen from Governor Newsom. Gee [...]

Retail shops will pay less for excise tax effective July 1, 2022

CORRECTION posted July 5, 2022 Effective July 1, 2022, the CDTFA is making a change to the cannabis excise tax. Old rate The old rate [...]