Volume 1, Issue 6

The Newsletter’s Aim

Weeding the News – a breakdown of the month’s cannabis news, important events, and top-notch accounting tips – aims to entertain and inform you as we watch the cannabis industry transform before us.

The information contained in Weeding the News issues is provided for informational purposes only and should not be construed as tax or legal advice.

SPECIAL EDITION: CALIFORNIA WILDFIRES: PART II

© 2025 BTA Corp. All rights reserved.

What’s on the Docket

We return with updates on the L.A. fires, covering the gamut of the good, the bad, and the ugly and unknown. We discuss some of the more uplifting news, such as the Pacific Coast High reopening and the record-setting GoFundMe money already raised, and cover some of the issues the industry is still contending with. And, in honor of Black History Month, we share insight from several well-respected cannabis professionals who give their thoughts on how the industry has been treating its Black members.

The Good

The majority of the fires have now been contained. Read more.

The Pacific Coast Highway has reopened after being closed for almost a month. However, Los Angeles County Supervisor Lindsey has urged only “essential traffic” to use California’s famous highway. Read more.

Governor Gavin Newsom has announced an additional food benefit program for Los Angeles residents that meets a few criteria, including being a family of four on an income of up to $3,529 per month. Read more.

Middle schoolers from Pacifica have started a fundraiser that has already raised thousands of dollars. Read more.

More than $250 million has been raised in support of the victims of the L.A. fires, which surpassed funds raised for all other disasters last year. Read more.

Citizens of the Chatsworth area apprehended a man allegedly trying to start a fire. Police were soon dispatched to the scene and arrested the man. Read more.

The FireAid benefit concert raised over $100 million for Los Angeles wildlife recovery. Read more.

Los Angeles real estate developer Rick Caruso is spearheading a foundation, Steadfast LA, to support rebuilding the affected areas. Read more.

© 2025 BTA Corp. All rights reserved.

The Bad

The total costs of the fires may very well prove to be one of the most expensive natural disasters the country has ever seen. Read more.

Over 2 million acres of California land have been designated as having a “high” to “very high” risk of future fires. Read more.

© 2025 BTA Corp. All rights reserved.

The Ugly and the Unknown: Lingering Questions

While millions of dollars have been raised, many Los Angeles citizens are still trying to access funds and question where and when they will come. Read more.

LA residents are wondering if they’ll be able to be insured in the future, noting that State Farm dropped them as clients, citing an inability to insure over 70,000 policies for the company’s “long-sustainability.” State Farm recently announced a 22% rate increase for homeowners and a 15% increase for renters. Read more.

Many L.A. residents are questioning how protocols will change in the future to prevent further loss of life and property as such disasters threaten the disabled with a unique set of difficulties. Read more.

Getting Help

To give or receive help, please see our previous issue covering the Los Angeles fires.

Major Fires Breakdown

Here are the brief statistics for the California wildfires as of February 17, 2025, verified by the NY Times, the Los Angeles Fire Department, and other official sources. Some information may be incomplete or unavailable for all fires.

Palisades Fire:

- Acres burned: 23,707

- Structures destroyed: 6,831

- Deaths: 12

- Missing people: 2

- Containment: 100%

Eaton Fire:

- Acres burned: 14,021

- Structures destroyed: Over 9,400

- Deaths: 17

- Missing people: 12

- Containment: 100%

Hurst Fire:

- Acres burned: 771

- Containment: 100%

Lidia Fire:

- Acres burned: 395

- Containment: 100%

Sunset Fire:

- Acres burned: 46

- Containment: 100%

Kenneth Fire:

- Acres burned: 1,052

- Deaths: 1

- Containment: 100%

Archer Fire:

- Acres burned: 19

- Containment: 100%

Hughes Fire:

- Acres burned: Over 10,278

- Containment: Unknown (previously reported at 24%)

Sepulveda Fire:

- Acres burned: 45

- Containment: Unknown (previously reported at 60%)

![]()

Upcoming Events

Lucky Leaf Expo Minneapolis 2025

Minneapolis, MN, February 28 to March 1

A conference for cannabis professionals to discuss developments in the industry relative to the Minnesota scene.

Benzinga Cannabis Market Spotlight

Somerset, NJ, March 4

A networking event where industry insiders come together, establish connections, and help shape New Jersey’s future in cannabis.

NECANN Boston 2025

Boston, MA, March 21-22

A cannabis convention dating back to 2014 dedicated to increasing marketing opportunities for cannabis professionals.

NCIA Stakeholder Summit Series

Sacramento, CA, April 10

Denver, CO, Apr 29

A venue for members and others to discuss policy and regulatory developments at the state and federal levels.

Washington, D.C., May 13-15

Further, the NCIA will be hosting its 13th Annual Cannabis Industry Lobby Days, a premier advocacy event as well as its stakeholder summit series.

Industry Insight

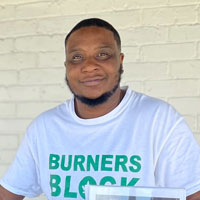

Shawn Williams

Founder of Burners Block

“When we talk about Black History Month in the cannabis space, we can’t just celebrate legacy without confronting the hypocrisy that still haunts us. We honor the pioneers, but too many of their descendants are still locked up for the same plant that’s making others rich. We love to talk about equity, but we need to be real about the barriers Black entrepreneurs face – limited access to capital, systemic discrimination, and regulatory red tape designed to keep us out.

“When we talk about Black History Month in the cannabis space, we can’t just celebrate legacy without confronting the hypocrisy that still haunts us. We honor the pioneers, but too many of their descendants are still locked up for the same plant that’s making others rich. We love to talk about equity, but we need to be real about the barriers Black entrepreneurs face – limited access to capital, systemic discrimination, and regulatory red tape designed to keep us out.

“Until we dismantle the systems that criminalized us in the first place, ‘equity’ is just a buzzword. It’s not enough to be included; we need to own the narrative and the industry. Black History Month shouldn’t be a marketing ploy – it should be a call to action. If you’re profiting from this plant, you owe it to the culture to fight for justice, not just join the trend.”

© 2025 BTA Corp. All rights reserved.

Tax Preparation

Our friends at the IRS have prepared some helpful Tax Tips for the impending tax season (source: IRS.Gov).

Taxpayers should start gathering and organizing records to get ready for filing their 2024 federal tax return. They need all year-end income documents to help ensure they file a complete and accurate 2024 federal tax return and avoid refund delays.

The Get Ready page on IRS.gov offers practical tips and resources to help taxpayers prepare. It highlights key updates and important steps for making tax filing easier in 2025.

Much-Needed FAQs

Instead of answering questions that have been asked all the time, we offer a few questions that should be asked. If asked, the questions would save you a lot of time and trouble. Trust us.