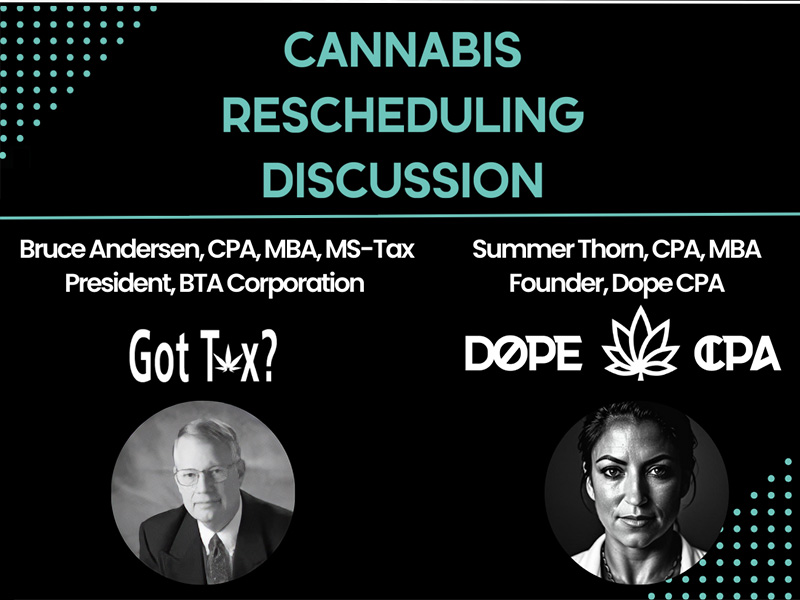

Speaker: Join CannabisCPA.Tax as we delve into the DEA’s recent rescheduling of cannabis and its impact on the cannabis industry. We’re hosting a discussion to answer your questions about the changes in 280E, tax implications, and how your cannabis business can adapt and thrive in this new landscape.

May 9, 2024

10:00 am – 11:00 am

Cannabis Rescheduling Discussion event webpage here.

Website:

https://dopecpa-280e-discussion.my.canva.site/dopecpa

Agenda:

- Introduction: Briefly introduce the topic and the significance of the rescheduling of cannabis to Schedule III.

- Impact on Tax Implications: Discuss how this change affects 280E and the tax implications for cannabis businesses.

- Changes in Cost Accounting: Talk about potential changes in cost accounting for cultivators and manufacturers.

- Effects on State Laws: Discuss the potential decoupling of state laws from federal law in light of the elimination of 280E.

- Implications for Banking and Financial Services: Discuss how the rescheduling could affect the banking and financial services available to cannabis businesses.

- Q&A Session: Open the floor for attendees to ask their questions and engage in a discussion.